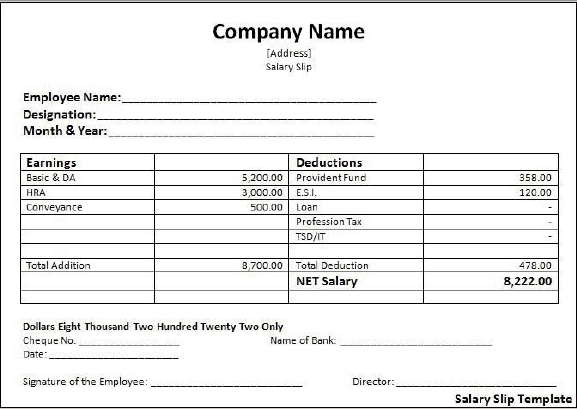

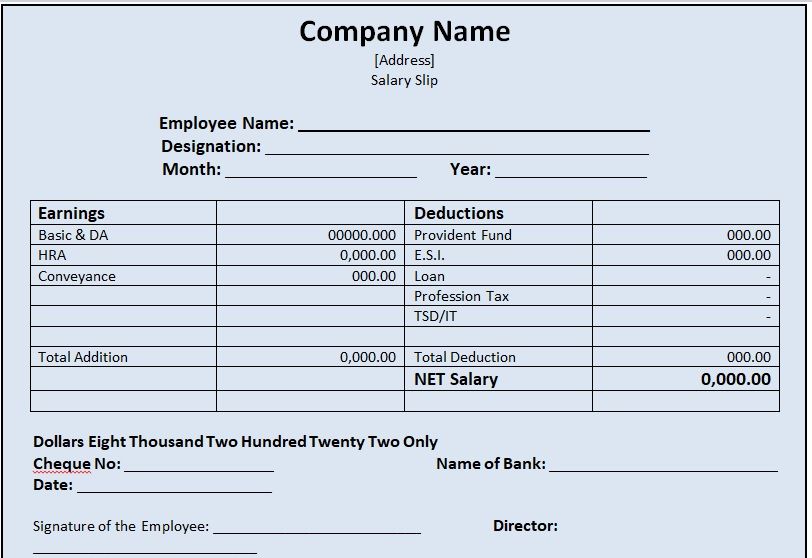

a HR & payroll software makes it easy to calculate, control and generate reports. Most companies prefer using a hrm payroll software to generate salary slips and pay stubs. it also contains the details of statutory tax deductions like PT, PF, TDS, insurance cost, etc. The main components of a salary slip are Basic Pay, House Rent Allowance (HRA), TA, DA, Reimbursements, Medical, Bonus, etc. of hours paid for, tax deductions, paid to the employee. Breakdown of hours worked: This is included for employees who are paid hourly.A salary slip, payslip, or pay stub is payment advice issued to the employees of an organization once their salaries are credited into their accounts.Ī simple salary slip format contains a detailed breakup of the gross and net salary, no.Date: The date the salary slip was issued.Net pay: This is the amount of money an employee takes home after all deductions have been taken.

Tax purposes: Salary slips are important for tax purposes as they show the amount of money an employee has earned in a given period, which is used to calculate the taxes they owe.Proof of income: A salary slip serves as proof of income, which can be required for various purposes such as applying for a loan, opening a bank account, or even for immigration purposes.In details, Salary slips serve as an important record of an employee's income and can be used for various purposes, including: It is an important document that serves as proof of income and can be used for various purposes such as applying for loans, opening a bank account, or filing taxes. It provides a detailed breakdown of the employee's gross pay, deductions, and net pay, as well as other important information such as the date, employee's name and identification number, and employer's name and address. A salary slip, also known as a pay stub or payslip, is a document that summarizes the amount of money an employee earns in a given period, typically a month.

0 kommentar(er)

0 kommentar(er)